Managing your finances is crucial to your success if you’re a small business owner. However, keeping track of your finances can be a daunting task. That’s where business accounting management software comes in. With the right software, you can easily manage your finances, track expenses, create invoices, and more. In this blog post, we’ll review some of the best accounting management software services options for small businesses. Whether you’re a freelancer, a solopreneur, or a small team, there’s something for everyone. Let’s get started!

What Is Accounting Management Software?

Accounting management software is a crucial tool for small businesses to manage their finances. It is a computer program designed to help businesses streamline their accounting processes and track financial transactions. With the most popular accounting management software, businesses can easily manage their finances, generate invoices, track expenses, manage payroll and taxes, and generate financial reports. This software provides businesses with real-time financial information that helps them make informed decisions about their finances. Using accounting management software, businesses can save time and reduce errors by automating repetitive tasks. Overall, it is an essential tool for small businesses to manage their finances efficiently and effectively.

Benefits of Using The Best Accounting Management Software:

There are several benefits of using the best accounting management software for small businesses, including:

- Streamlining accounting processes: Accounting management software can automate tasks such as bookkeeping, invoicing, and financial reporting, saving time and reducing errors.

- Improved financial decision-making: The software provides real-time financial information, allowing businesses to make informed decisions about their finances.

- Cash flow management: With accounting management software, businesses can easily track cash flow and forecast future cash needs, helping to ensure financial stability.

- Budgeting and forecasting: The software can assist businesses in creating budgets and forecasts, giving them a clear picture of their financial situation and helping them plan for the future.

- Expense tracking: Accounting management software enables businesses to track expenses accurately, providing insights into spending patterns and helping to identify areas for cost savings.

- Payroll and tax management: The software simplifies payroll and tax management, ensuring compliance with regulations and minimizing the risk of errors.

However, using the best accounting management software services can help small businesses manage their finances efficiently and effectively, saving time and reducing costs while providing valuable financial insights.

List Of Top 10 Best Accounting Management Software

Zoho Books:

Zoho Books is a powerful accounting management software that helps small businesses manage their finances efficiently. It offers features such as invoicing, expense tracking, bank reconciliation, and inventory management. Users can also generate financial reports such as balance sheets, profit and loss statements, and cash flow statements. Zoho Books integrates with other Zoho apps as well as third-party apps such as PayPal and Stripe.

It also supports multi-currency transactions and allows users to set up recurring transactions. Zoho Books provides a user-friendly interface and mobile apps for both iOS and Android platforms. With its affordable pricing plans and comprehensive features, Zoho Books is a great choice for small businesses looking for reliable accounting management software. It can help businesses save time, reduce errors, and make informed financial decisions.

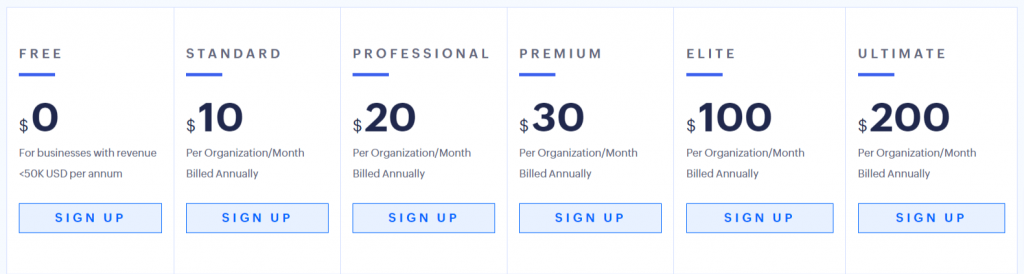

Zoho Books Pricing Plans:

Xero Accounting Software:

Xero is a cloud-based accounting management software that helps small businesses streamline their financial operations. It offers features such as invoicing, expense tracking, bank reconciliation, and inventory management. Xero integrates with over 800 third-party apps, making it easy to connect with other business tools such as payment gateways and customer relationship management (CRM) systems.

It also provides comprehensive financial reports such as balance sheets, profit and loss statements, and cash flow statements. Users can access Xero from anywhere with an internet connection, and it offers mobile apps for both iOS and Android platforms. With its user-friendly interface and affordable pricing plans, Xero is an excellent choice for small businesses looking for an efficient accounting management solution.

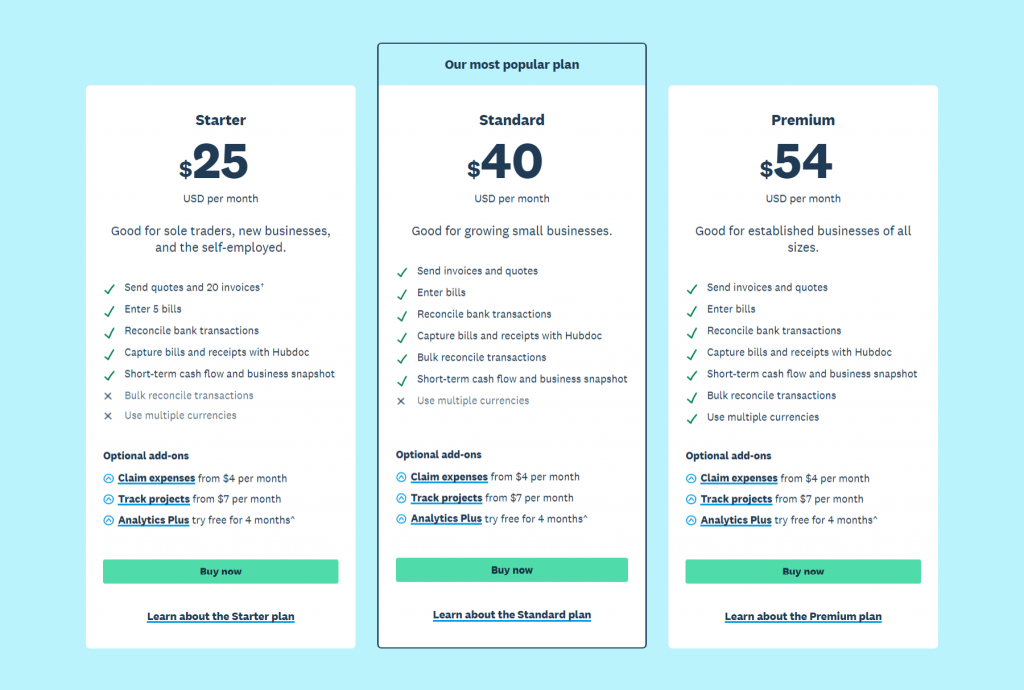

Xero Pricing Plans:

FreshBooks:

FreshBooks is an accounting software designed for small business owners to simplify financial management. Its features include invoicing, time tracking, expense tracking, project management, and reporting. Users can create and send professional invoices, set up recurring payments, and track expenses easily. FreshBooks also integrates with over 200 third-party apps, including PayPal, Stripe, and Zapier.

Its time-tracking feature helps to bill clients accurately and track billable hours. The software generates insightful financial reports, including profit and loss statements, balance sheets, and expense reports. FreshBooks has a user-friendly interface and provides mobile apps for both iOS and Android platforms. It offers a 30-day free trial, and its affordable pricing plans make it an excellent choice for small businesses looking for an easy-to-use accounting solution.

FreshBooks Pricing Plans:

Sage Business Cloud Accounting:

Saga Accounting is a cloud-based best accounting software designed for small and growing. It offers invoicing, bank reconciliation, expense management, VAT returns, and financial reporting features. Saga Accounting provides real-time updates and automatic bank feeds that enable users to stay on top of their finances. Users can also create and send professional invoices and automate payment reminders. The software generates VAT returns automatically, making tax compliance easier for business owners.

Saga Accounting’s financial reporting feature enables users to generate customised reports, including profit and loss statements and balance sheets. The software is fully compliant with HMRC regulations, and its secure cloud-based platform enables users to access their financial information from anywhere. Saga Accounting provides a simple pricing model, with no hidden fees or charges, making it an excellent choice for small businesses looking for a reliable accounting solution.

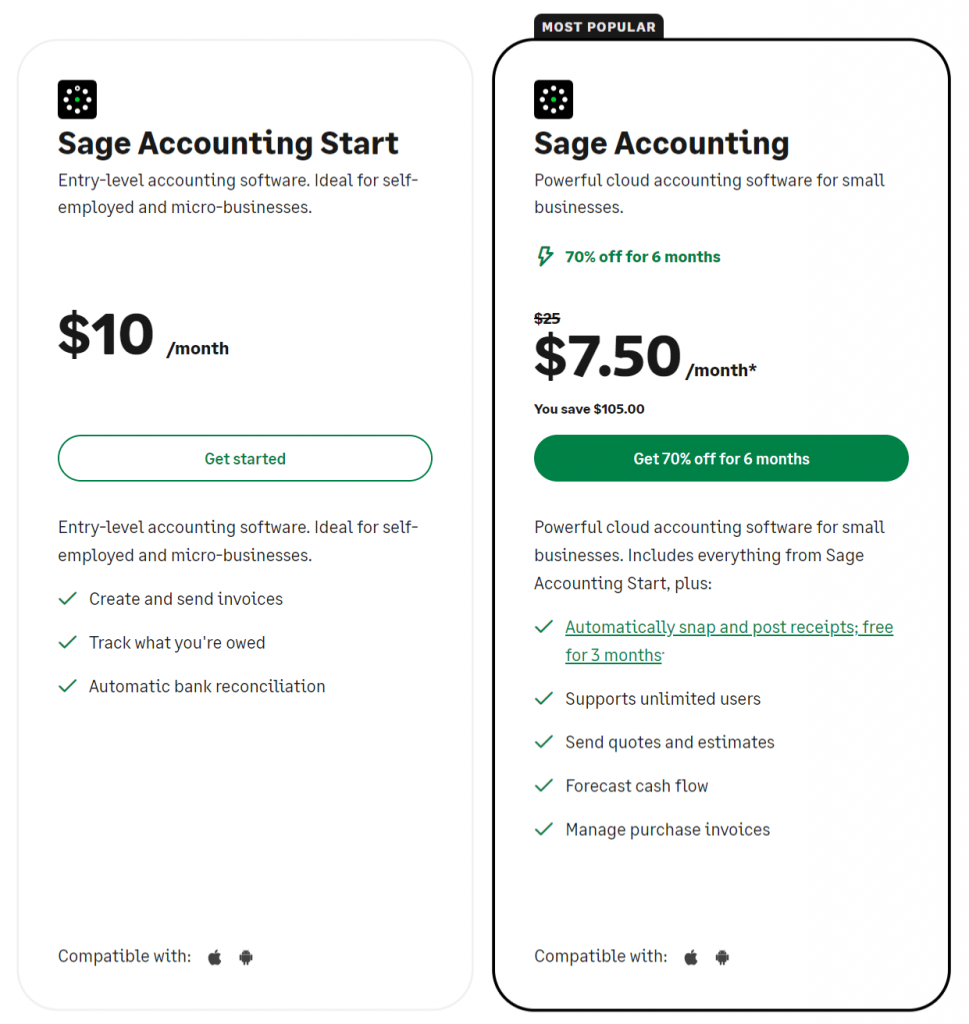

Saga Pricing Plans:

Kashoo Accounting Software:

Kashoo is the world’s simplest accounting software designed for small businesses. It offers a bunch of great features such as invoicing, expense tracking, bank reconciliation, and financial reporting. Kashoo’s invoicing feature enables users to create and send professional invoices, set up recurring payments, and track outstanding balances. Its expense tracking feature allows users to record expenses and receipts easily, while the bank reconciliation feature helps to keep track of cash flow.

Its financial reporting feature helps you to generate insightful reports such as profit and loss statements, balance sheets, and cash flow statements. The software also supports multi-currency transactions, making it easy for users to conduct business with international clients. Kashoo provides mobile apps for both iOS and Android platforms, enabling users to access their financial information on the go. With its affordable pricing plans and user-friendly interface, Kashoo is an excellent choice for small businesses looking for a reliable accounting solution.

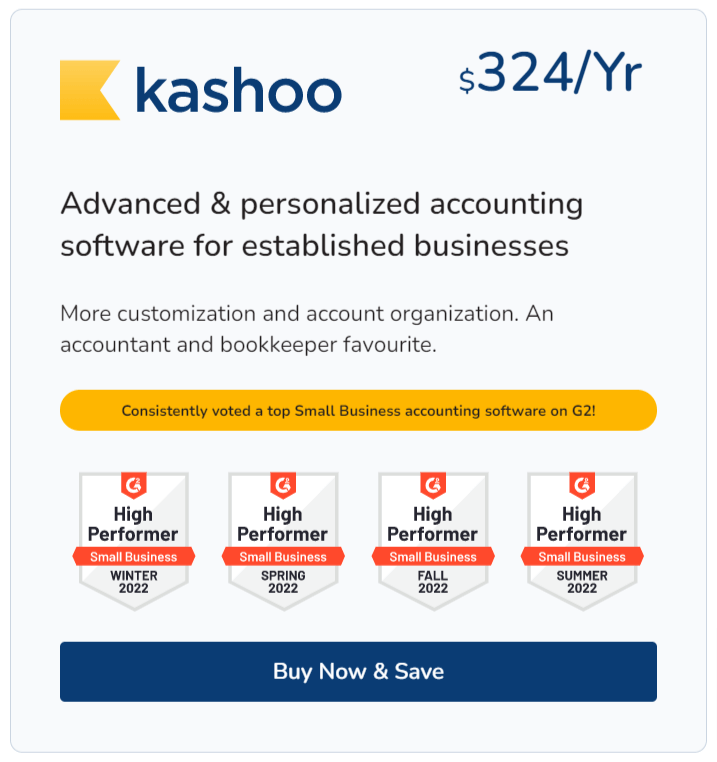

Kashoo Pricing Plans:

QuickBooks:

QuickBooks is a cloud-based accounting software designed for small and medium-sized businesses. It offers smarter features such as invoicing, expense tracking, bank reconciliation, payroll management, and financial reporting. QuickBooks’ invoicing feature enables users to create and send professional invoices, set up recurring payments, and track outstanding balances. Its expense tracking feature allows users to record expenses and receipts easily, while the bank reconciliation feature helps to keep track of cash flow.

QuickBooks’ payroll management feature enables users to process payroll, pay employees, and calculate taxes accurately. Its financial reporting feature generates insightful reports such as profit and loss statements, balance sheets, and cash flow statements. QuickBooks integrates with over 650 third-party apps, making it easy for users to connect with other business tools. The software also provides mobile apps for both iOS and Android platforms, enabling users to access their financial information on the go. With its comprehensive features and user-friendly interface, QuickBooks is a popular accounting solution for small and medium-sized businesses.

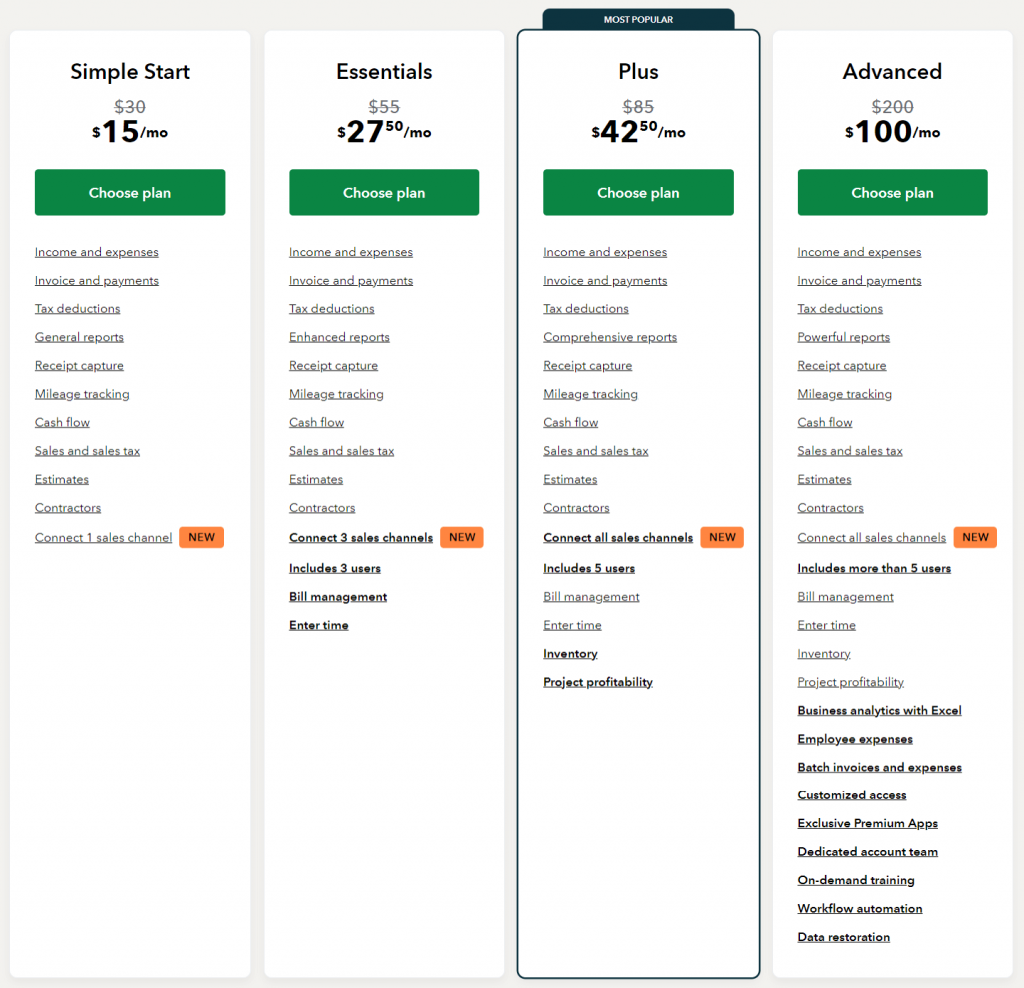

QuickBooks Pricing Plans:

Wave:

Wave Accounting software is a simple, reliable and secure cloud-based accounting software. It is specifically designed for stress-free small business accounting. It offers features such as invoicing, payment processing, receipt scanning, and expense tracking. The software allows users to create and send professional invoices, with options to accept credit card payments and set up recurring billing. Users can also track expenses by importing bank and credit card transactions, as well as by manually entering receipts.

It also offers a payroll feature, with the ability to pay employees and contractors, as well as to file and pay payroll taxes. The software is free to use, with no hidden fees, although users can opt to pay for additional services such as premium support, bookkeeping, and tax services. Overall, Wave Accounting is a simple and user-friendly accounting software that provides basic accounting features for small businesses without requiring extensive accounting knowledge.Top of Form

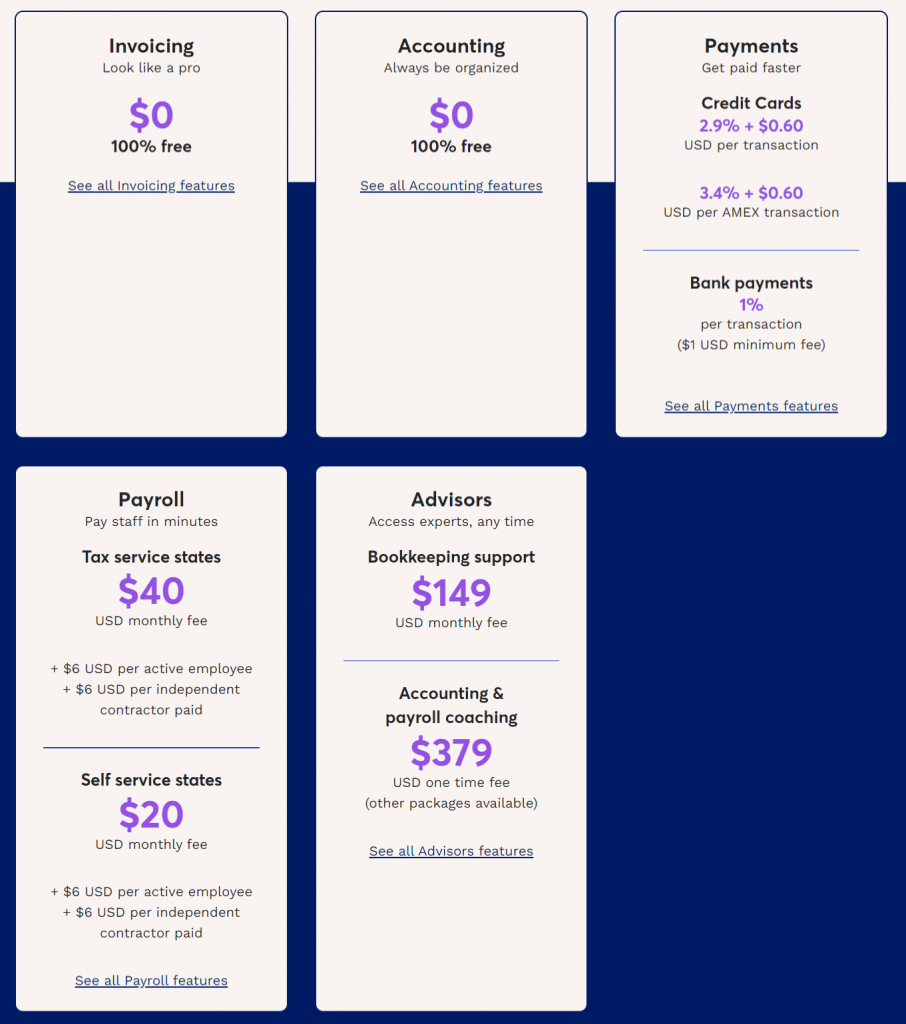

Wave Pricing Plans:

Patriot:

Patriot is cloud-based accounting and payroll software designed for small businesses. The software is affordable, powerful and very easy to use. It offers features such as invoicing, expense tracking, and financial reporting. Users can create and send professional invoices, with the option to accept credit card payments and set up recurring billing. The software also allows for easy expense tracking by importing bank and credit card transactions, as well as by manually entering receipts.

Patriot Accounting offers a payroll feature, with the ability to pay employees and contractors, as well as to file and pay payroll taxes. It also provides financial reports such as profit and loss statements, balance sheets, and cash flow statements. The software is affordable, with pricing plans based on the number of users and the features needed. Users can cancel or change plans at any time without penalty.

This makes Patriot Accounting one of the best accounting management software for small businesses. It provides a user-friendly interface and essential accounting features at affordable pricing.

Patriot Pricing Plans:

AccountEdge Pro:

AccountEdge Pro is a desktop-based accounting software designed for small to medium-sized businesses. It offers complete small-business accounting and management solutions for the Mac office. You can find amazing features such as invoicing, inventory management, and payroll processing. Users can create and customize professional invoices, track inventory levels, and manage customer and vendor information. The software also includes time billing and project management features for businesses that bill by the hour.

It also includes a payroll feature with the ability to pay employees and contractors, as well as to file and pay payroll taxes. It also offers financial reporting such as profit and loss statements, balance sheets, and cash flow statements. The software is available for a one-time purchase, with pricing based on the number of users and the features needed. Users can also purchase a support plan for additional assistance.

Overall, AccountEdge Pro is a best accounting management software with advanced features for businesses that require more than basic accounting capabilities. Its desktop-based system allows for more control and security over financial data.

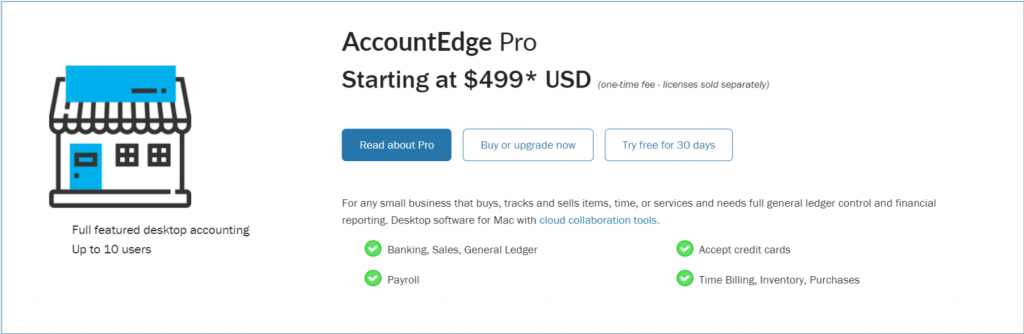

AccountEdge Pro Pricing Plans:

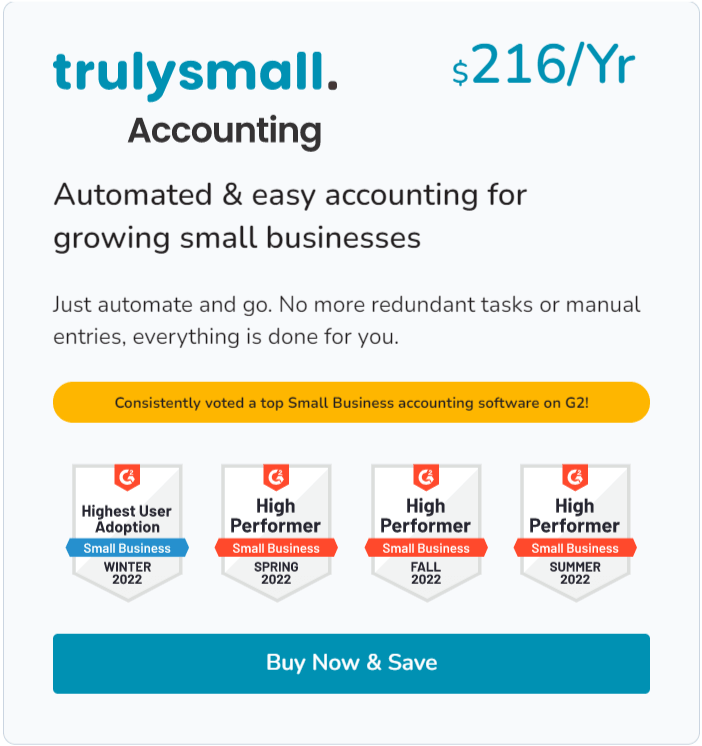

Trulysmall Accounting Software:

Trulysmall accounting software is a reliable and efficient tool for managing your accounting requirements. It offers an intuitive dashboard with easy-to-use features like invoicing, expense tracking, and financial reporting. You can track employee reimbursement and manage your taxes with this software. Plus, it supports multiple currencies, making it an ideal tool for global businesses.

Trulysmall provides an affordable solution for small and medium businesses, freeing up time and resources for you to focus on growing your business. With real-time insights, you can ensure that your financial decisions are informed and accurate. Trulysmall accounting software is a great choice for businesses looking to streamline their accounting operations and manage their finances more effectively.

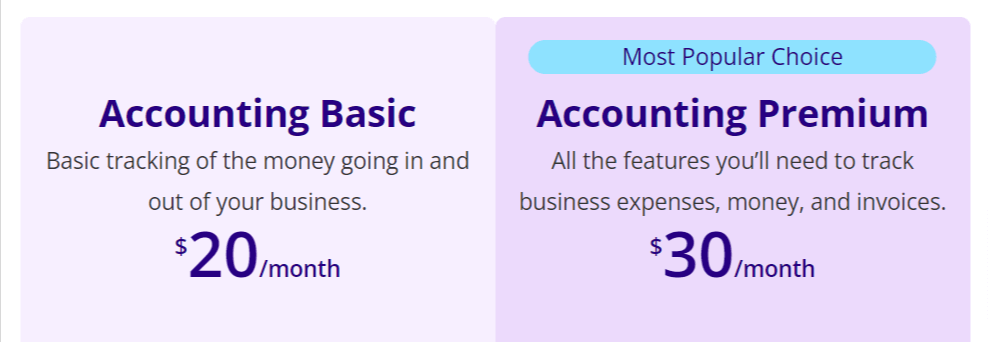

Trulysmall Pricing Plans:

Conclusion –

Selecting the right accounting management software for your small business can have a significant impact on your financial operations. From invoicing and expense tracking to payroll processing and financial reporting, the software you choose should meet your business needs and budget. Our comprehensive guide has explored some of the best accounting management software options available, including Wave, QuickBooks, Patriot, AccountEdge Pro, and Xero. Each software has its strengths and weaknesses. The key is to find the one that aligns with your specific business requirements.

By investing in the right accounting software, you can streamline your financial processes, improve accuracy, and gain better insight into your business finances. So, take the time to evaluate your options and choose the software that will help you achieve your financial goals.

FAQs – Best Accounting Software

What Features Should I Look for in Accounting Software for Small Businesses?

The features you should look for in accounting software for small businesses depend on your business needs. However, some essential features include invoicing, expense tracking, payroll processing, financial reporting, and integration with other business applications. Cloud-based software with mobile access is also important for businesses that need to work remotely.

What is the Best Accounting Software for Small Businesses?

The best accounting software for small businesses depends on your specific business needs and budget. Some popular options include Wave, QuickBooks, Xero, and FreshBooks. Each software has its strengths and weaknesses, and it’s important to evaluate them carefully to find the best fit for your business.

Is Best Business Accounting Software for Small Businesses Expensive?

Accounting software for small businesses can range from free to several hundred dollars per month, depending on the features and services offered. However, there are affordable options available, such as Wave and Patriot Accounting, that provide basic accounting features at no cost or for a low monthly fee

Can Most Popular Accounting Software be Used by Non-Accountants?

Yes, accounting software for small business is designed to be user-friendly and accessible to business owners and employees without extensive accounting knowledge. The software provides tools and features that simplify financial tasks and automate repetitive processes, making it easier for non-accountants to manage their business finances.

Can Accounting Software be customized to my business needs?

Yes, most accounting software can be customized to some extent to meet your specific business needs. This can include customizing invoices, creating custom financial reports, and integrating with other business applications. However, the level of customization depends on the software you choose and the features it offers.