When it comes to managing your business’s finances, using the right banking software can make all the difference. With the right product, you can quickly and easily handle a variety of financial tasks from your computer or phone. To help you find the best online banking software for your business, our experts have researched the most popular options and have outlined their features and benefits.

From cloud-based services to mobile banking apps, this guide will help you determine which online banking software is right for your business. With the right software, you can streamline your finances, reduce costs and manage your accounts with ease. Make sure to read through this article and consider all of the options before making a decision – the right software can make a big difference in how your business operates.

What Is Online Banking?

Online banking allows enterprises or businesses to conduct financial transactions via the Internet. Online banking is also known as E-banking or web banking. It offers transaction tracking, payment transfer, treasury, wealth management, notifications, and more. In the mid-90 usage of online banking by enterprises came into existence in huge numbers because of low operating costs. The main aim of e-banking services is to provide businesses with much faster services at a low cost. The process of online banking has also been sped up with the help of an information system.

Reason Why Online Banking Is Important For Business In Today’s Time

- Convenience – Online banking allows businesses to access their accounts 24/7, making it easy to review transactions and manage finances on the go.

- Security – Online banking provides secure encryption and additional layers of security protection to safeguard business accounts.

- Cost Savings – Online banking reduces the cost of maintaining paper records and the need for manual processing of payments or transfers.

- Streamlined Payments – Online banking simplifies bill payments and automated transfers, making it easier for businesses to stay on top of their finances.

- Insights & Analysis – Most online banking software provide access to data analytics tools and real-time account activity insights.

- Improved Cash Flow Management – Online banking helps businesses easily track cash flow and reduce the need for costly bank transfers.

- Increased Interactivity: Online banking lets businesses interact with customers and employees through secure platforms.

- Increased Employee Engagement: Online banking allows employees to easily access finances and account information, helping to keep teams organized and compliant with corporate policies.

- Improved Customer Relationship Management: E-banking software offer enhanced customer service capabilities that help businesses build positive relationships with their customers.

Top 5 Online Business Banking Accounts for 2023

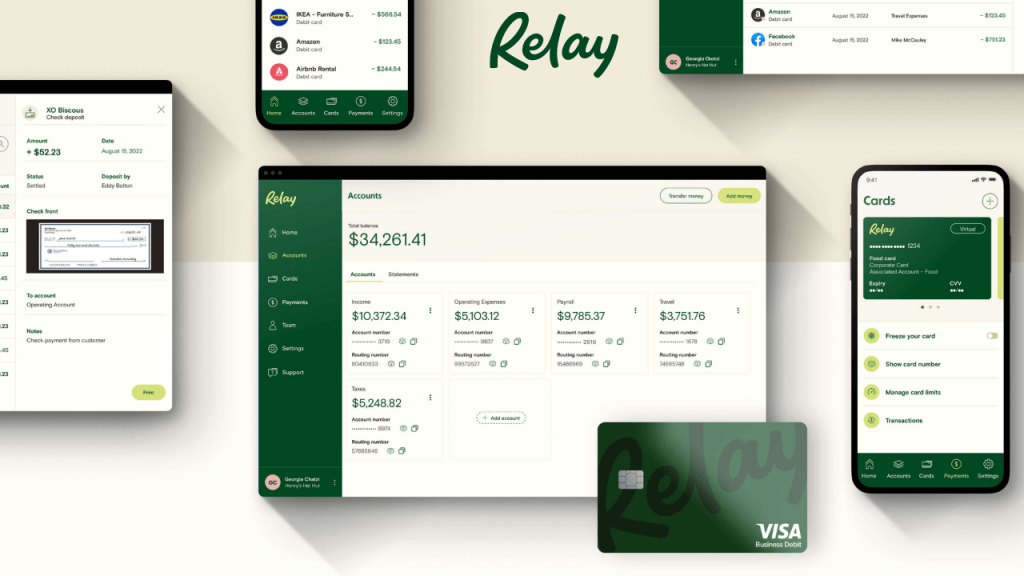

Relay:

Relay is one of the best online banking and money management platforms. It puts you in complete control of your cash flow. It makes it easy for entrepreneurs to understand precisely what they are earning, spending and saving. This helps them to make the smartest decision for their business. Beyond the business banking basic it offers 20 checking accounts and can issue up to 50 MasterCard debit cards which may be physical or virtual debit cards.

Novo:

Novo is the powerful, simple and best online banking software for businesses. It is one of the top choices for entrepreneurs and e-commerce. It was made for how business works today, with a mobile app that lets you pay bills, send invoices, and transfer money. You can do much more when you scan checks and handle other common banking tasks. That’s because nothing on your phone takes more than a few swipes.

It also offers easy integration with Quickbooks and Xero for accounting and bookkeeping needs, stripe for payment processing, Zapier for CRM and marketing, Shopify and eBay if you have an eCommerce. It makes sending voice, tracking them and getting paid on your terms easy. This makes Novo the best online banking software for small and mid-size businesses.

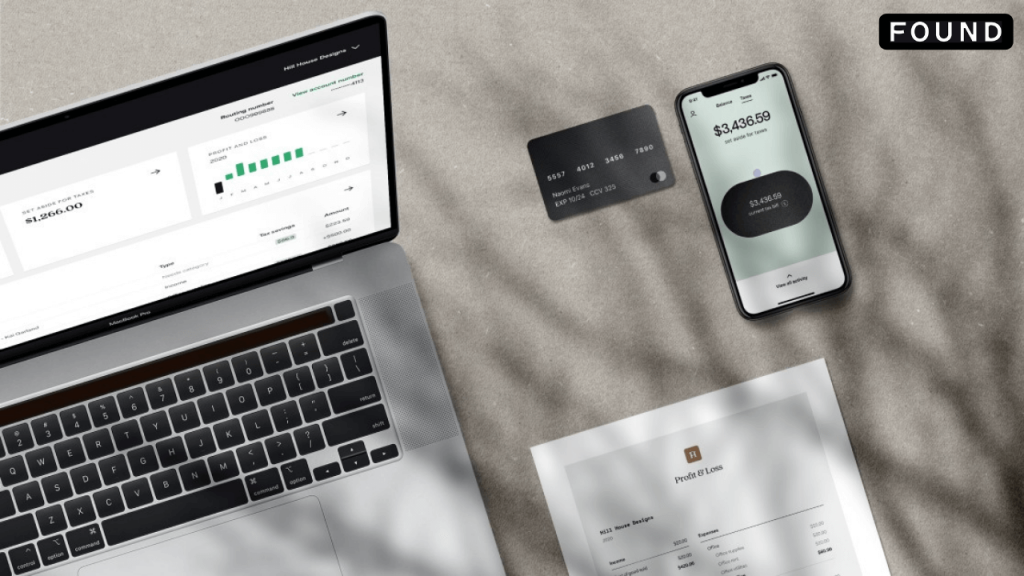

Found:

People who are self-employed can get some of the best online banking services from Found. A single app gives you everything you need to handle payments, bills, and taxes. Found doesn’t give a stripped-down version of their full business banking as many of their competitors do. Instead, Found was made from scratch to serve people that run their own shows.

It is quite easy to create and send an invoice with Found without jumping between multiple apps. You track all your transaction in one place. You can even connect it with Square, Cash App, PayPal, and other popular payment gateways.

Lili:

Lili is the perfect solution for all your business financial needs which includes banking, accounting, and taxes. It is flexible, modern, and free of hidden fees like our other recommendations. Instead of having multiple apps, you can get everything done in Lili. It is simple to categorize spending, scan receipts, and set aside money for taxes all year long.

With Lili, staying on task is just so easy. Each invoice may be created, sent, and stored right in the app. You can send as many invoices as you like, and you can personalize them by including your company’s logo. It doesn’t have many intricate software integrations. But compared to many other corporate banking options, the app itself offers a lot more functionality. For small business owners who don’t want to rely on many apps just to execute routine transactions, this can be a major advantage.

Mercury:

Mercury is one of my top picks for startups since it offers the same level of convenience and flexibility as many of its rivals while also enabling you to pay staff, provide them with debit and credit cards, and sync your accounts with the programs you already use. It offers all the tools and services an entrepreneur needs to build a company. It helps you create virtual debit cards and track your cash flow.

Also, you can easily manage Stripe, Amazon, Shopify, and PayPal integration. Move money with simplicity, issue physical and digital cards to employees, and generate detailed reports on all transactions.

List of Best Accounting Software/ Online Banking Software

- Zoho Book

- Freshbooks

- Xero

- Saga (Peachtree)

- Keshoo

- QuickBooks

- Wave

- Patriot

- Account Edge Pro

- TruelySmall

Based on our research and analysis, we have concluded that the best online banking software is the one that offers a seamless user experience, robust security measures, and convenient features. Ultimately, the best online banking software for you will depend on your specific needs and preferences.