Are you looking for the best online payment system? Are you overwhelmed by the vast array of options available? If yes, then you have come to the right place! In this blog post, we will explore the various features of the best online payment system so you can make an informed decision.

From security and privacy to ease of use and cost-effectiveness, we will review all the components you must consider when selecting an online payment system. With our guidance, you can be sure that your choice will be best for your business needs. So, let’s get started!

What Is an Online Payment System?

As a business owner or entrepreneur, an online payment system or payment processing software refers to a digital platform that allows your customers to make payments for your goods or services over the Internet. These payment systems enable you to receive payments electronically from your customers, without the need for physical cash or checks.

Online payment systems provide a convenient and secure way for your customers to make payments, which can help to increase customer satisfaction and loyalty. They also offer a range of benefits for your business, including faster payment processing times, reduced transaction costs, and improved cash flow management.

When choosing an online payment system or payment processing software, it is important to consider factors such as transaction fees, security measures, and ease of use. Also, ensure the payment system is compatible with your website or e-commerce platform. Make sure it has the features and functionality that you need to effectively manage your payments and financial transactions.

By implementing an online payment system, you can streamline your payment processes, improve your customer experience, and help to grow your business in the digital age.

Best Online Payment Systems | Payment Processing Software For 2023

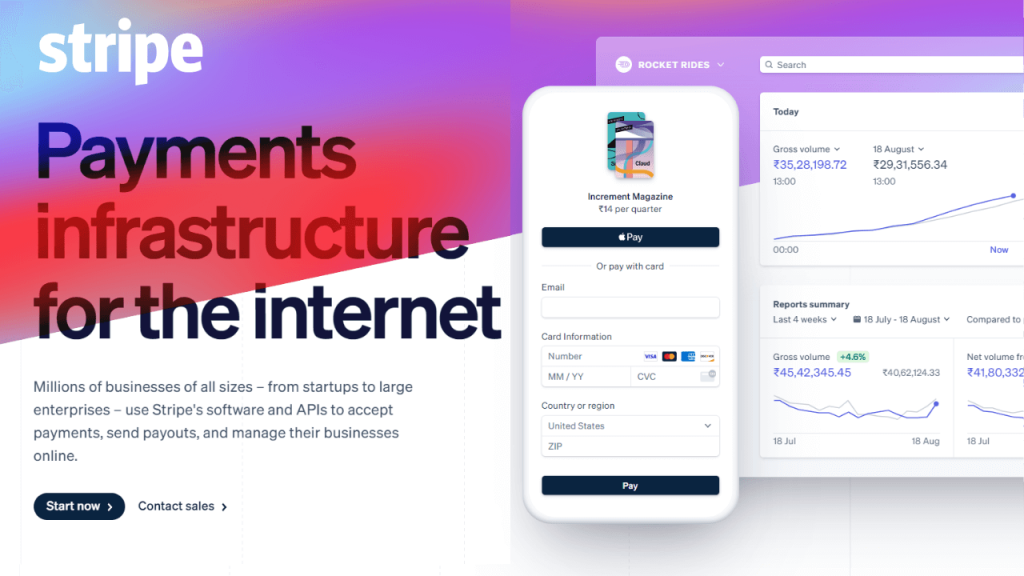

Strip:

Stripe is an innovative online payment processing software that enables businesses to accept payment over the Internet. It has become increasingly popular due to its powerful features and ability to process payments quickly. Stripe helps businesses of all sizes to accept payments from customers in a secure, fast, and reliable manner. The payment system also supports a wide range of currencies and payment types to make it easier for customers to pay.

Here are some of the key features of Stripe: Accepts various payment methods, supports over 135 currencies, including PCI compliance, two-factor authentication, fraud protection tools, customizable checkout forms, real-time transaction reporting and analytics.

Overall, Stripe offers comprehensive payment processing software that is easy to use, secure, and highly customizable. It is a popular choice for businesses of all sizes, from startups to large enterprises, and can help to streamline payment processes, improve cash flow management, and enhance the customer experience.

PayPal:

PayPal is an online payment gateway that allows users to send and receive payments over the Internet. It links your website to your processing network and merchant account. Like most gateway services, Payflow Payment Gateway works with all major credit and debit cards.

Here are some features of the PayPal payment gateway: Payment processing, Security, buyer and seller protection, international transactions, mobile payment, integration, etc.

Overall, we can say that PayPal is a reliable, secure, and widely used payment system that offers many features and benefits to users.

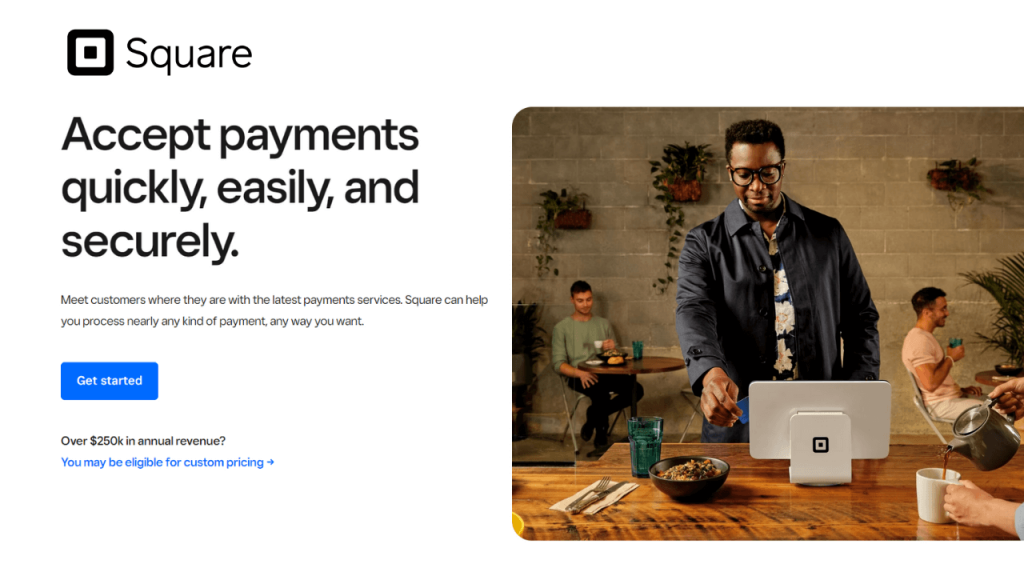

Square Payments:

Square Payments is another best online payment system that enables businesses to accept payments from customers using a card reader attached to a mobile device. This contactless payment system is a great way for businesses to accept payments quickly, easily and securely from customers in person. The Square Payments system is also suitable for online payments, allowing customers to pay for goods and services on their website or app. This makes Square Payments a great choice for businesses looking for an affordable payment processing system.

Here are some features of Square: Easy payment processing, fast transactions, secure payments, low transaction fees, business analytics, easy integration and point of sale(POS) software.

Overall, Square is a comprehensive payment processing system that offers businesses a range of features and services. Its free POS software, range of payment options, and analytics tools make it a popular choice for small and medium-sized businesses.

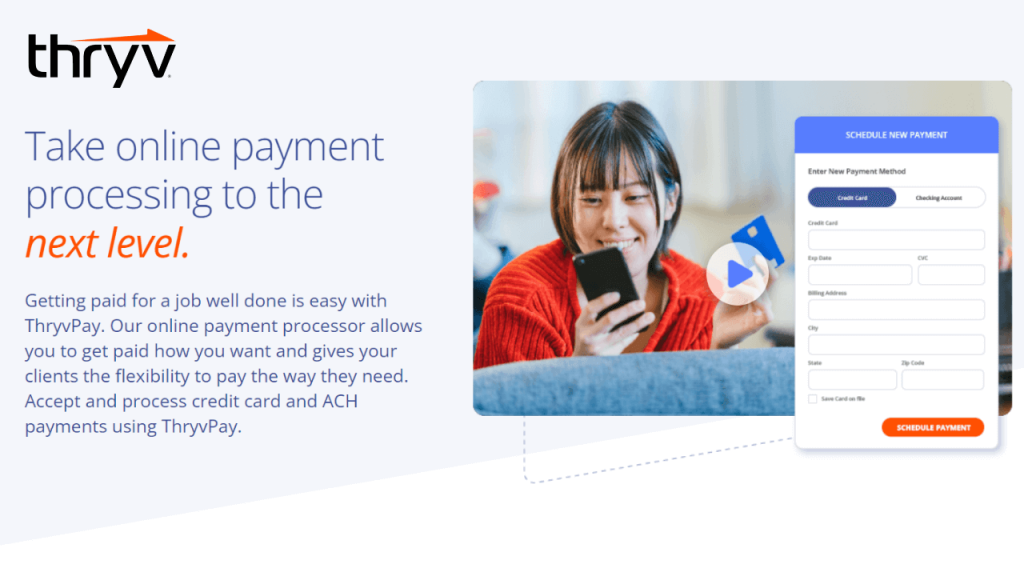

Thryv:

Thryv is an all-in-one business management software that provides a suite of tools to help small businesses manage their operations, including online payments. With its online payment system is easy and secure to take payments from customers. This revolutionary platform allows businesses to accept payments through a wide range of payment methods, including credit cards, debit cards, and ACH payments. Thryv not only provides a secure payment gateway but also offers a range of features to help businesses manage their finances.

Here are some features of Thryv Online Payment: Payment Processing (Easily accept credit card, wallet pay, tap to pay and ACH payments) Invoicing, Automatic Payment reminders, Payment tracking, Security, easy integration with other tools and platforms, customer Portal, etc.

Overall, Thryv Online Payment is a comprehensive payment processing system that provides businesses with a range of features and tools to help them manage their payments and financial operations more efficiently. Its invoicing and payment tracking features, as well as its automatic payment reminders, make it a popular choice for small businesses.

GoCardless:

GoCardless is another popular online payment processing system that allows businesses and individuals to securely accept payments. It’s incredibly simple to get started with GoCardless, as it only requires you to enter your bank details and start collecting payments. It is fully integrated with leading e-commerce platforms, making it easy to integrate into any website. Furthermore, the system offers a range of features that make it an ideal choice for anyone looking to streamline their payment processing.

Here are some features of GoCardless: Collect payments directly from customers’ bank accounts via direct debit, Recurring Payments, Automated Payment Processing, Payment tracking Tools, Froud detection and prevention tools, International Payment Support, and Connect to one of 350+ other systems.

Overall, GoCardless is a payment processing system that specializes in recurring payments via direct debit. Its automation tools, payment tracking features, and integration options make it a popular choice for businesses that rely on subscription-based models.

Cashfree Payment Gateway:

Cashfree is an online payment gateway service that enables businesses and individuals to receive and make digital payments securely and quickly. It is one of the popular payment gateway software in India and offers a wide range of payment options to its users. It is easy to use, secure, and cost-effective. By using the Cashfree payment gateway businesses can accept payments from customers through their website, mobile app, or email.

Features of Cashfree Payment Gateway: Multiple Payment Options, Easy integration with website and mobile apps, Fast settlements, Secure Transactions, Customizable Checkout Pages, Automated Reconciliation, 24/7 Customer support, Real-time Analytics and Reporting, etc

Overall, Cashfree is the most reliable and user-friendly payment gateway software that provides businesses with a hassle-free payment solution and customers with a seamless payment experience.

Veem:

Veem is a global payment processing system that offers businesses an easy and secure way to send and receive payments across borders. It is a cloud-based platform that simplifies the payment process and reduces the time and cost associated with cross-border transactions. It offers multiple options for payments and money transfers, including wire transfers, ACH payments, and cryptocurrency.

Features of Veem Payment Processing System: Multiple Payment Options, Competitive Exchange Rates, Easy Integration with existing software and website, Multi-factor authentication, encrypted data transfer, Automated Reconciliation, Real-time Tracking, 24/7 Customer Support, etc

Overall, Veem is a reliable and cost-effective payment processing system that simplifies cross-border transactions for businesses of all sizes. It offers a range of features that make it easy for businesses to send and receive payments globally while ensuring the security and transparency of transactions.

Venmo:

Venmo is one of the leading payment processing software companies & mobile-based digital payments It is a great way to quickly transfer funds and make payments without the. Businesses can leverage the platform’s social sharing features to generate brand exposure and appeal to a mobile-first audience. Venmo facilitates payments by directly linking debit cards or bank accounts and stored account balances.

Features of Venmo Payment Processing System: Easy to Use, Social Features, Multiple Payment Options, Instant Transactions, PIN authentication, two-factor authentication, encryption of data, Split Payments, Free Transactions, etc

Overall, Venmo is a popular and user-friendly payment processing system that makes it easy for users to send and receive payments from their friends and family members. It offers a range of features that make it a social payment system while ensuring the security and convenience of transactions.

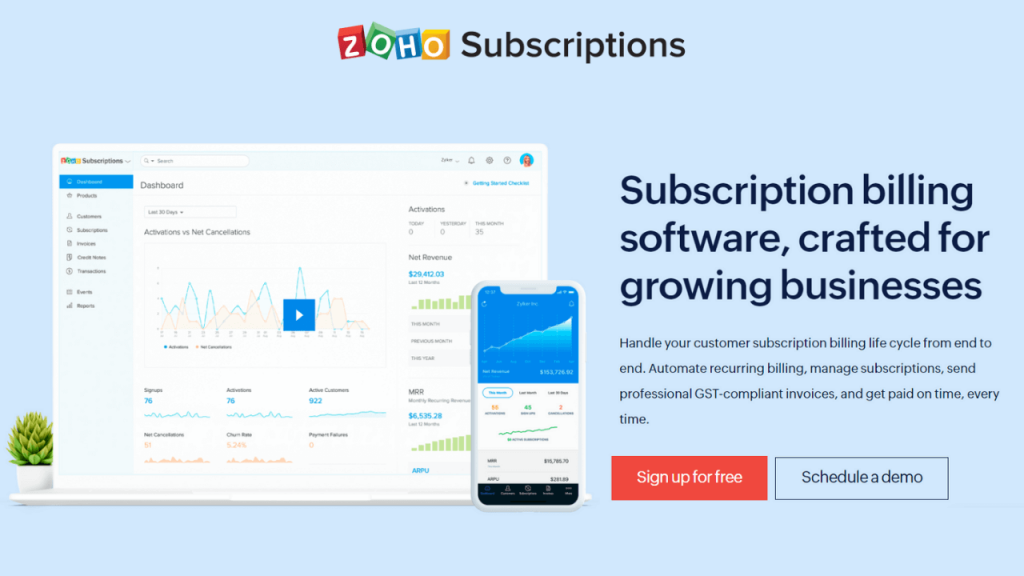

Zoho Subscription:

Zoho Subscriptions is a subscription-based payment processing software that enables businesses to manage and automate their recurring billing and subscription payments. It is a cloud-based platform that simplifies the subscription management process and reduces the time and effort involved in managing recurring payments. This powerful platform offers a range of features to support the entire subscription lifecycle from order to renewal.

Features of Zoho Subscriptions Payment Processing Software: Flexible Payment Options, Recurring Billing, Subscription Management, Revenue Recognition, Dunning Management, Customizable Invoices, Automate Payment Collection, and Reporting and Analytics.

Overall, Zoho Subscriptions is a powerful and user-friendly payment processing software that enables businesses to manage their subscription payments efficiently and effectively. It offers a range of features that simplify the subscription management process and reduce the time and effort involved in managing recurring payments.

FreshBooks:

FreshBooks is a cloud-based accounting software that offers payment processing capabilities to small businesses. It is designed to simplify the invoicing and payment process for businesses, allowing them to get paid faster and more efficiently. With FreshBooks, you can securely accept payments online from customers, regardless of their payment method.

Features of FreshBooks Payment Processing Software: Online Payments, Recurring Invoices, Payment Reminders, Late Fees, Automated Deposits, Client Portal, and Multi-Currency Support.

Overall, FreshBooks is a user-friendly payment processing software that enables businesses to manage their invoicing and payment process efficiently and effectively. It offers a range of features that simplify the payment process and reduce the time and effort involved in managing invoices and payments.

FAQs – Best Online Payment System | Payment Processing Software

What Is Payment Gateway Software?

Payment gateway software is a tool that facilitates online transactions by connecting a business’s website or application to a payment processor. It enables businesses to accept and process various types of payments securely and efficiently, such as credit and debit card payments, e-wallet payments, and bank transfers.

What Are Some Popular Payment Gateway Software Options?

There are many payment gateway software options available, including PayPal, Stripe, Cashfree, Square, and GoCardless. The right option for a business will depend on its specific needs, such as transaction volume, payment methods, and security.

How Do I Choose Online Payment Software?

Choosing online payment software can be a critical decision for any business that wants to accept payments from customers securely and efficiently. Here are some key factors to consider when choosing online payment software:

- Security: Look for online payment software that offers robust security features such as encryption, fraud prevention, and compliance with industry standards such as PCI DSS.

- Payment methods: Choose payment software that supports a range of payment methods, such as credit/debit cards, e-wallets, and bank transfers, to give customers more options to pay.

- Ease of use: The software should be user-friendly and easy to integrate with your website or application. A seamless payment experience can help reduce cart abandonment and increase conversions.

- Fees: Compare the pricing and fees of different payment software options, including transaction fees, setup fees, monthly fees, and any other costs associated with using the software.

- Customer support: Choose payment software that offers reliable customer support, including responsive customer service and clear documentation and resources.

- Reputation: Research the reputation and track record of the payment software provider, including reviews, ratings, and any past security breaches or issues.

By considering these factors, businesses can make an informed decision when choosing online payment software that meets their needs and helps them provide a seamless and secure payment experience for their customers.

Which Is the Best Payment Processing Software?

There is no single “best” payment processing software as each software has its unique features and capabilities that cater to different businesses needs. The right payment processing software for a business will depend on various factors, such as the volume of transactions, the types of payments accepted, the level of security required, and the business’s budget.

Each software offers unique features and pricing models, and businesses should carefully evaluate the options and select the one that best fits their needs.

Ultimately, businesses should choose payment processing software that aligns with their specific needs and goals, including their budget, payment methods, security requirements, and user experience.