Are you finding it difficult to keep a monthly track of your employees’ payroll? If yes, then payroll software is the best solution for your business!

Payroll software is a critical tool for every business, in order to manage the payments of its employees, efficiently and effortlessly. It is very essential to choose the right payroll software for your business, as it will help you save both time and money. The most effective payroll software provides various special features like automatic computations, paycheck direct deposit, computerised tax filing, and employee self-service.

In addition, it also comes up with great customer service, comprehensive reporting options, and comprehensive integration options. While selecting the best payroll software for your business, you should consider the factors like cost, ease of use, scalability, and ability to handle complex payroll scenarios. Once you know what to look for, you can confidently make an informed decision on the best payroll software to meet your business needs.

To help you make a better choice, we have come up with some useful information about the best payroll software solutions for your small business.

This article consists of detailed information about the top 10 best payroll software. But Before jumping straight to the list, let’s first understand payroll software.

What Is Payroll Software?

Payroll software is a computer program designed to streamline and automate the process of calculating and managing employee wages, benefits, and taxes. It helps businesses accurately process payroll, generate paychecks or direct deposits, calculate tax withholdings, and maintain compliance with labour laws and regulations.

Payroll software is commonly used by human resources departments and accounting professionals to ensure accurate and timely payment to employees.

Key Features of Payroll Software Typically Include:

- Employee Information Management: It allows you to store and manage employee data such as personal details, salary information, tax information, and employment status.

- Time and Attendance Tracking: Payroll software often integrates with timekeeping systems or offers its own time tracking functionality. It enables accurate recording of employee attendance, work hours, leaves, overtime, and other relevant data.

- Salary Calculation: The software automatically calculates salaries and wages based on the information provided, including hours worked, overtime, bonuses, and deductions. It takes into account factors such as tax rates, retirement contributions, insurance premiums, and other applicable regulations.

- Tax and Statutory Deductions: Payroll software assists in calculating and deducting income tax, social security contributions, healthcare premiums, and other statutory deductions from employees’ salaries, ensuring compliance with local tax regulations.

- Direct Deposit and Payment Management: It enables businesses to facilitate direct deposit payments to employees’ bank accounts, generate pay stubs, and manage payment schedules efficiently.

- Tax Reporting: Payroll software generates reports and statements required for tax filing purposes, including W-2 forms, 1099 forms, and other necessary tax reports.

- Compliance and Legal Requirements: The software helps organizations stay compliant with labor laws, tax regulations, and other legal requirements by automating calculations and providing necessary documentation.

- Integration with Accounting Systems: Payroll software often integrates with accounting systems, allowing seamless transfer of payroll data for financial record-keeping and reporting.

By utilizing payroll software, businesses can reduce manual errors, save time, increase accuracy, maintain compliance, and enhance overall payroll management efficiency.

Now without wasting time let’s get started with the list of best payroll software from which you can select the most suitable for your business needs.

Here is the list of the Top 10 Best Payroll Software Solutions For Small Businesses.

1. Gusto Payroll

Gusto is the most picked payroll software that is easy to use and seriously smart. It helps you run payroll as many times each month as per your need without charging extra. Gusto is specifically designed considering startups and small businesses in mind. It offers payroll for both employees and contractors. It also provides employees benefits like wellness, healthcare, retirement plans, and more.

The software offers amazing features which make him the best payroll software solution for small businesses. Gusto is used by more than 2lakhs businesses and is recognized it as the best Payroll and HR platform.

Key Features and Offerings:

- Unlimited and Autopilot Payroll

- Automatically files payroll taxes.

- Built-in time tracking and benefits

- Self-setup employee portal

Pros

- Easy integration with tools like Xero, Clover, and QuickBooks Time.

- Ability to administer small business.

- Allows you to pay in more than 80 countries.

- Automatic tax filings and compliance guidance

Cons

- Not satisfying customer service and the onboarding experience

- Reporting features might be made easier

- No account receivable or invoicing features

- Lacks compliance support

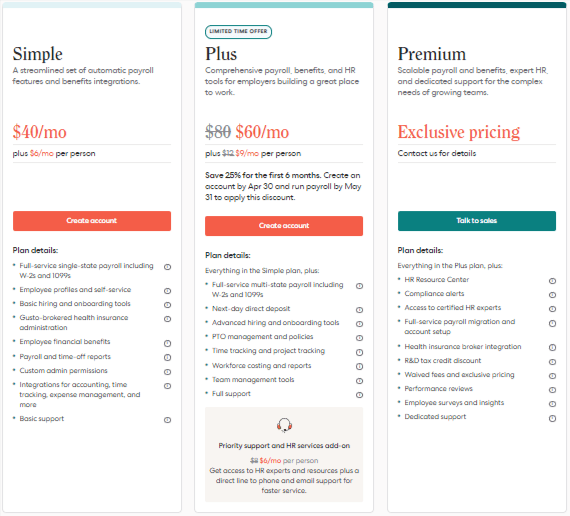

Gusto Pricing:

2. Patriot Payroll

Patriot is another best payroll software and tax service for small businesses. The platform is so user-friendly that you can run payroll in just three steps. It has come with the mission to make accounting and payroll simple, and fast, and millions of American businesses and their accountants. Also, Patriot’s software undergoes a total of 20,000 tests before a new tax calculation is introduced. The accuracy of your payroll reports makes you feel relaxed.

Key Features and Offerings:

- Quick and Easy 3-step payroll run process (Free payroll setup and unlimited payrolls)

- Accurate payroll and tax calculation (Local, state, federal, and year-end)

- Customizable hours, deductions, money type, and pay frequencies

- A net-to-gross payroll tool

Pros

- User-friendly platform for both desktop and mobile

- Easy integration of accounting software

- Multi-location support for businesses

- Easy to pay by dept

- Print reports and easily apply filters

- Some instructions could be more detailed

Cons

- Payroll reports are not very customizable and somewhat basic.

- Charges extra for e-filling and additional state tax filing if you file in multiple states.

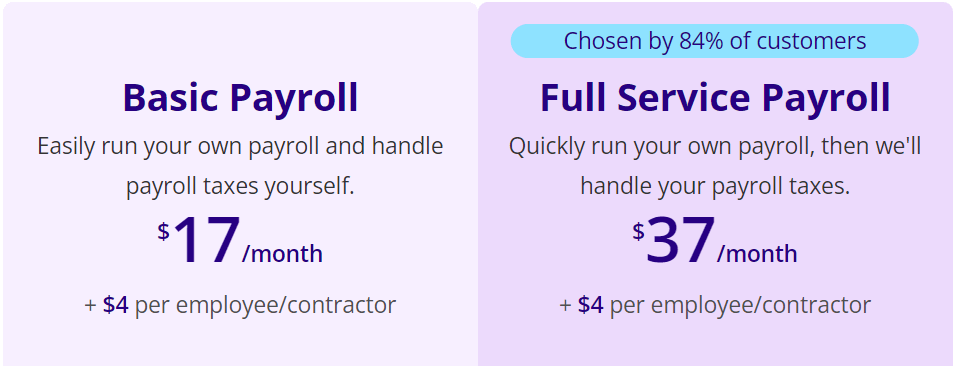

Patriot Pricing:

3. QuickBooks Payroll

QuickBooks is one of the most popular payroll tools and the best fit for business owners who are already using QuickBooks accounting software. Just with a few steps you easily activate payroll software within QuickBooks online. It offers three versions of software that are Payroll Core, Payroll Premium, and payroll Elite which come in 3 different pricing plans. This makes QuickBooks one of the best payroll software for US-based small and mid-sized businesses.

Key Features and Offerings:

- Automatic Payroll

- Next-day or same-day direct deposit

- Benefits, Payroll and Compensation Management.

- Payroll Reporting and W-2 Reporting

- Vacation and Leave Tracking

Pros

- Accuracy guarantee and tax penalty protection.

- Excellent customer service

- User-friendly software

- Benefits administration at all levels

Cons

- Extra Filing fees for Core and Premium plans

- Transferring data from another platform is risky. Limited integrations or add-ons

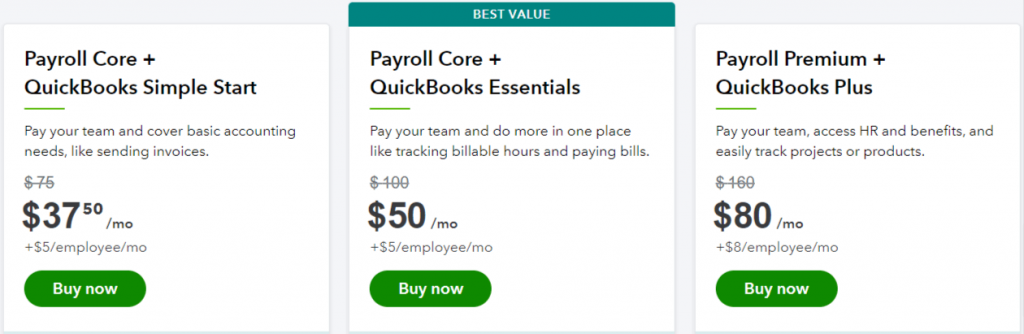

QuickBooks Payroll Pricing:

4. Wave Payroll

Wave payroll is another top option for small businesses looking to try other software for free. It is an easy-to-use and reliable payroll management tool for small businesses and freelancers. It provides 100% guaranteed accuracy, quick run payroll, and no hidden fees. Wave payroll offers different pricing plans for US and Canada.

If you are running your business in the US and Canada, this is one of the best payroll software alternatives.

Key Features and Offerings:

- Direct deposit

- Automatic payroll journal entries

- Pay employees and contractors

- Self-service pay stubs and tax forms

- Automate tax payments and filings

- Protect your team with workers’ comp

Pros

- All-in-one platform for payroll, accounting, and invoicing

- Accounting and Payroll are connected

- User-friendly interface

- Easy payroll for employees and contractors

Cons

- Automatic state and federal tax filing isn’t available in all states

- No mobile app

- No mailing service (checks or tax forms)

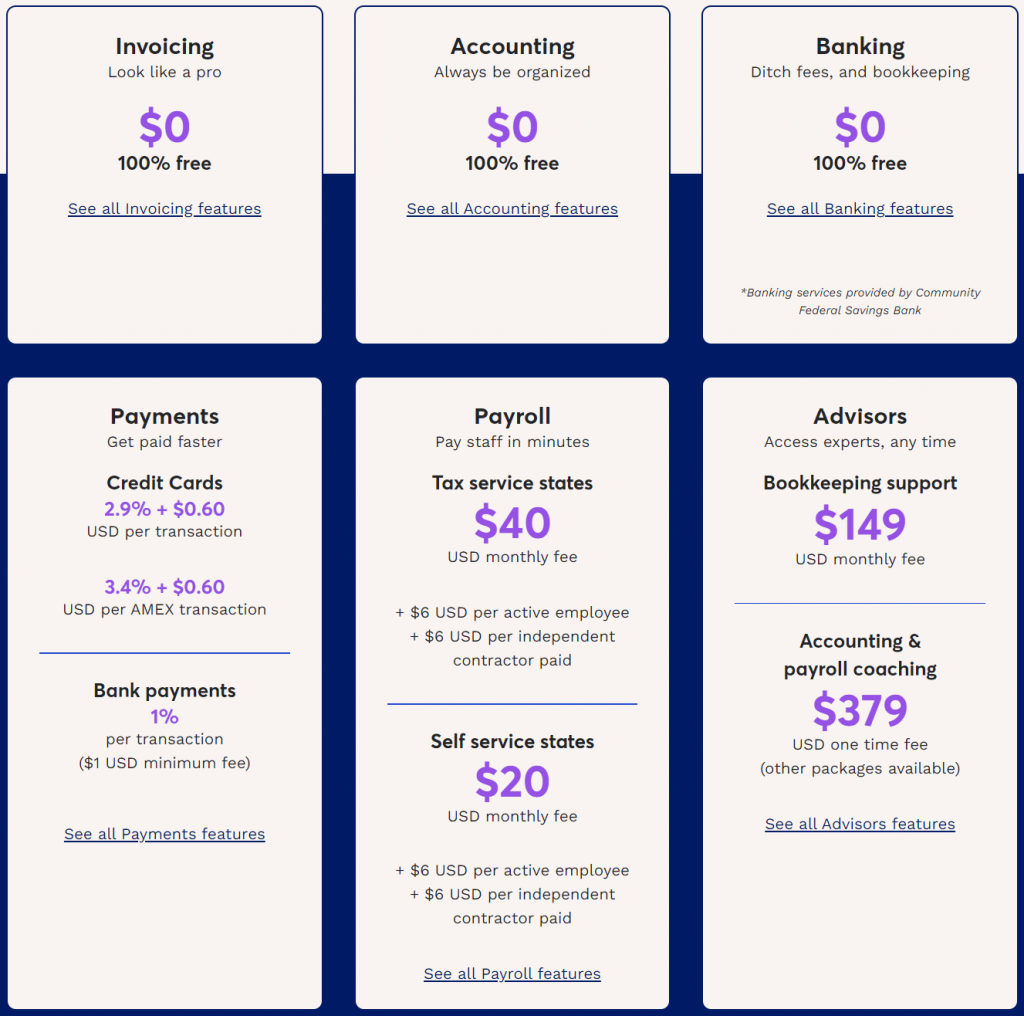

Wave Payroll Pricing:

5. Zenefits Payroll

Zenefits is a fully integrated, easy-to-use, and reliable payroll software. It offers an option that can help you automatically sync with other HR functions such as new hire onboarding, time tracking, and benefit deduction. Also, it claims to address the unique situation of one-man shops to thousand-person enterprises. But most importantly it offers personal demo accounts which help the client see if the software really meets their unique needs or not.

Key Features and Offerings:

- Direct deposits

- Unlimited pay runs, pay previews, and dynamic pay

- Automatic state and federal tax filing, new-hire state filing, and tax compliance

- Multiple pay rates and labour codes for easy analysis.

- Payroll, tax, and general ledger reporting

Pros

- Easy integration with many platforms and apps (e.g. Xero, Zapier, QuickBooks, etc)

- Competitive pricing plans

- Gives Choice between using own broker or Zenefits broker partners to administer employee benefits.

- Advisory services are given by an expert payroll team

Cons

- Lack of Customer support service, learning management tools, and task management features

- Payroll is an add-on to the base plan Paystubs must be accessible from the employee profile.

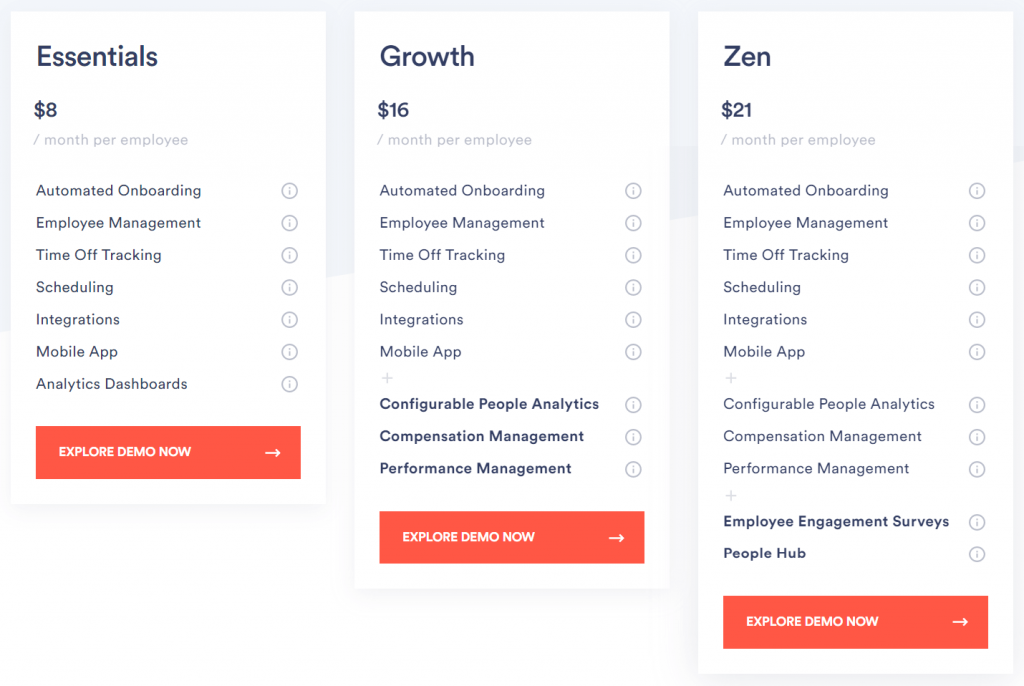

Zenefits Pricing:

6. OnPay Payroll

OnPay is one of the best payroll software for small and medium-sized businesses. It automates all the hard stuff so that you can focus on important stuff to grow a business. The software is backed by payroll experts as it provides the most flexible solution. If you pay contractors or part-time employees, OnPay may be a most suitable fit for your company because you are only billed for the people you actually pay during the month.

Key Features and Offerings:

- Tax filings and payment

- Unlimited payroll runs and multistate payroll

- Direct deposit, debit card, or printed check

- Report designer and custom reporting

- Offers special payroll services

Pros

- Offers all the payroll features plus HR tools and benefits administration.

- Easy integration of other tools

- Free account migration and integration setup

Cons

- Not suitable for employees outside the US

- No mobile app

- Mailing tax docs cost extra

- Payroll approval is not fully automated

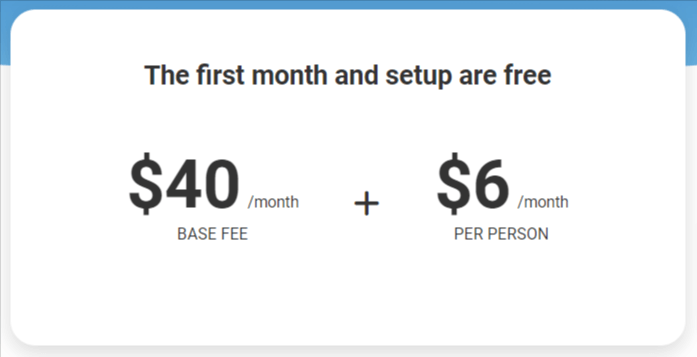

OnPay Pricing:

7. Square Payroll

Square has created its own space for small businesses. The software offers a lot more than just accepting payments. It is an all-in-one solution for managing payroll, tax filings, and benefits for your staff. In addition, you can reach out to real-time payroll experts with any questions. In simple words, Square gives you a suite of payroll tax software that all works together to provide integrated payroll services for your small business. This makes it one of the first choices of small businesses.

Key Features and Offerings:

- Automatic local, state, and federal payroll tax filings.

- Timecard, tips, and commissions integration

- Pay W2s/1099s hourly, salary, or custom amounts.

- Easy 5-step and multistate payroll processing for both employees and contractors

Pros

- Easy integration with Square products and third-party apps

- Free migration from earlier software

- 24/7 online payroll services

- Operates in all 50 states.

Cons

- No free trial

- Limited reporting

- Customization is not available for payroll dates

- Lack of customer service

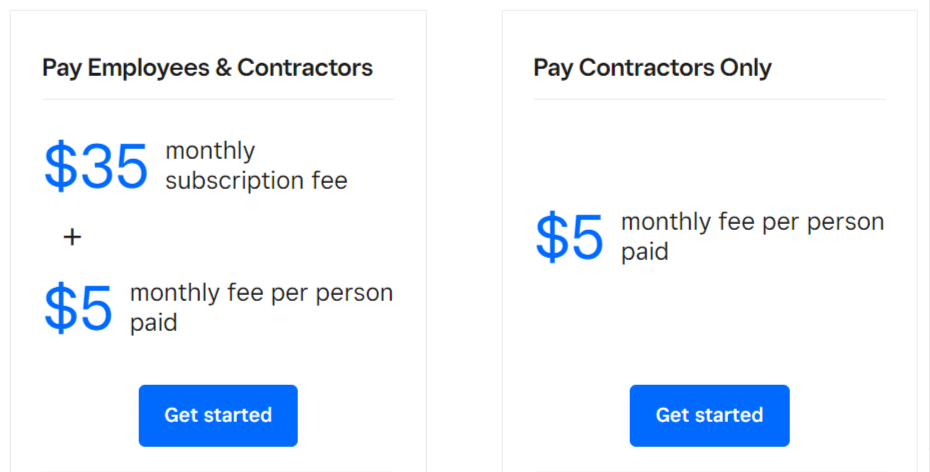

Square Pricing:

8. RUN Payroll Powered by ADP

ADP (Automatic Data Processing) is a very well-known name in business software. ADP has come with a payroll product named Run for small business. It has more than 700,000 small business clients. More than 2 million people have rated the app, which has an overall rating of 4.7 in the App Store and 4.5 on Google Play.

Using this software makes your and your employees’ life easier. So by looking at the offerings and business needs, I can say that Run payroll is one of the best payroll software for small businesses.

Key Features and Offerings:

- Error detection enabled by AI highlights potential faults before they become an issue.

- A mobile app allowing employees to easily access information about salary, scheduling, and perks while on the road.

- The calculation, filing, depositing, and reconciliation of payroll taxes are handled for you.

- Recurring payroll, multi-jurisdiction payroll, and flexible payment options.

- Payroll tracking and auditing

- Direct deposit

Pros

- User-friendly employee payroll

- Offers customizable plans

- Automatic tax filing and reports

- Provides add-ons for marketing and legal assistance

Cons

- Additional costs for tax form filing and benefits administration

- Need an additional product to pay contractors.

- Pricing estimates are hard to get

- Can be a little costlier for small businesses

Run Payroll Pricing:

9. Paychex Payroll

Paychex is a time-saving solution for payroll, HR, and benefits for businesses of all sizes. This software helps you to hire, pay, manage, and retain employees with confidence. It is a perfectly designed payroll platform for small businesses with less than 50 employees. It offers an easy-to-use basic payroll processing platform to pay employees and contractors, but it does not include HR and Benefits administration. The platform is a quick and simple payroll system specifically made by considering small businesses’ needs.

Key Features and Offerings:

- Employee Retention Tax Credit Service

- Multiple Employee Pay Options

- Review and Report Potential Issues Before Payroll Runs

- Integrated Payroll Solutions helps you to save time on data entry

- Provides access to employees’ payroll information online

- Provide payroll tax compliance support from knowledgeable professionals

Pros

- Easy-to-use employee payroll

- Includes Garnishment payment service

- Customizable plans

Cons

- Extra fee for payroll tax filing

- Extra fee for W-2 and 1099 filing

- No full HR suite

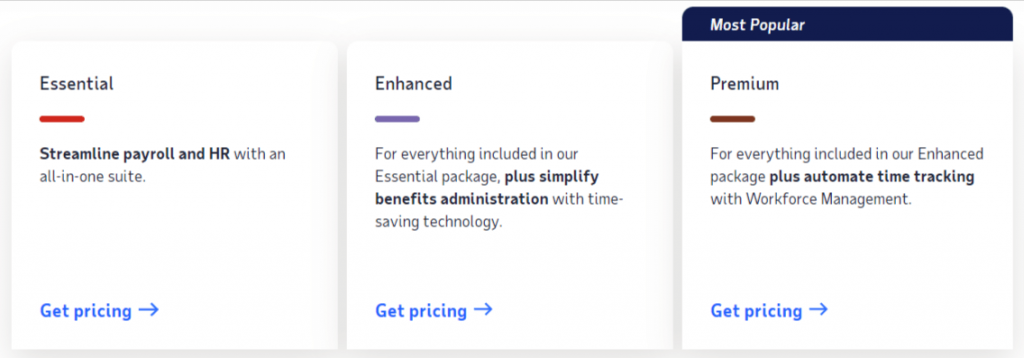

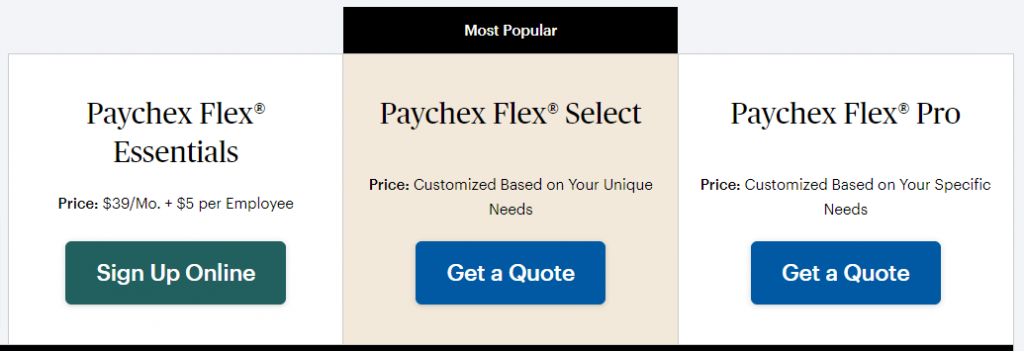

Paychex Pricing:

10. Justworks Payroll

Justworks is a simple software that provides expert support for payroll, employee benefits, HR services, and compliance to run your business with confidence. It gives you access to high-quality employee benefits such as medical, dental, and vision insurance, as well as 401(k) savings plans and perks for all small businesses at more affordable rates. With a professional employer organization (PEO) model Justworks becomes one of the best payroll software for small businesses.

Key Features and Offerings:

- Automatic direct deposits

- One-off payment

- Payroll tax filling

- Auto notifications

- Track Time and attendance accurately

Pros

- Seamlessly integrate payroll with your favourite accounting software.

- Easily sync timesheets to payroll

- Hand over 100% of your HR duties

- Smooth employee self-service interface

- PEO (co-employment) relationship reduces your liability as an employer

Cons

- High cost compared to others

- PEO (co-employment) relationship reduces your control over HR policies

Justworks Pricing:

All the above are the best payroll software for small businesses still, if you want to check out newly launched software then do visit on BufferApps platform. It is the best SaaS marketplace where you can try, test, and buy newly launched products at the best deal price.

Conclusion – Best Payroll Software

Selecting the best payroll software for small businesses is always a difficult task, but it is a crucial process to ensure that you are compliant with payroll regulations and that you are paying employees accurately and on time. While selecting the payroll software one should look at the options available, their offerings and features, customer review, and most importantly cost of the software. Also, the size of the business and its location has to be taken into consideration while selecting the software.

This article thus mentions all the required information that will help you choose the best one without any hassle.

If you feel this blog added value to your selection process, then do share it with others or on your socials, so that someone may benefit too.

FAQs – Best Payroll Software

Payroll software is beneficial for businesses of all sizes that have employees and need to manage their payroll efficiently. It is particularly useful for human resources departments, accounting professionals, and small to medium-sized businesses that want to streamline their payroll processes, ensure accuracy in salary calculations, and maintain compliance with tax and labour laws.

There are several popular payroll software options in India, and the best choice depends on the specific needs and requirements of the organization. Overall, the best payroll software provider in India is QuickBooks. But it is recommended to compare the features, pricing, scalability, customer support, and user reviews of different software options to determine the best fit for your organization.

Determining the “best” HR payroll software depends on various factors such as the specific needs of your organization, budget, and desired features. However, some popular and highly regarded HR payroll software options include Gusto, Zenefits, BambooHR, and Justworks. It’s recommended to evaluate different software providers based on your requirements and consider factors like user reviews, scalability, integration capabilities, customer support, and pricing to find the best fit for your organization.

The cost of payroll software varies depending on several factors, including the software provider, the size of your organization, and the specific features and functionalities you require. Payroll software is typically offered through subscription-based pricing models. Entry-level payroll software may start around $20 to $50 per month, while more advanced or enterprise-grade solutions can range from $100 to several hundred dollars per month. Some software providers also offer custom pricing based on the number of employees or additional services required. It’s advisable to obtain quotes from different vendors and consider the long-term value and benefits provided by the software before making a decision.